【2022-03-30】

@whigzhou: 经济领域未来几年的一大主题将是供应链再配置,每个供应来源国将依其可依赖程度被归入从核心到外围的一层层圈带,企业将基于这样的层次划分重新评估其供应链的总体可靠性,这种评估可以是自我评估,也可以是投资者、债权人、评级者或监管者实行的外部评估,企业将被鼓励提供这方面的披露,监管者甚至可能强制规定这样的披露,评估的结果自然会引发再配置过程,不是主动调整,就是被动调整,最终结果将是基于上述层次划分重新组合的新(more...)

【2022-03-30】

@whigzhou: 经济领域未来几年的一大主题将是供应链再配置,每个供应来源国将依其可依赖程度被归入从核心到外围的一层层圈带,企业将基于这样的层次划分重新评估其供应链的总体可靠性,这种评估可以是自我评估,也可以是投资者、债权人、评级者或监管者实行的外部评估,企业将被鼓励提供这方面的披露,监管者甚至可能强制规定这样的披露,评估的结果自然会引发再配置过程,不是主动调整,就是被动调整,最终结果将是基于上述层次划分重新组合的新(more...)

【2021-12-18】

美国在70年代之前和之后的增长模式十分不同,Tyler Cowen 在 The Great Stagnation 里提出过这个问题,后来 Robert Gordon在《美国增长的起落》里有更详尽的描述,

Cowen 指出的现象是清楚的,但他的分析不得要领,简单说,他认为原因是容易摘到的果子都已经摘掉了,新的增长点很难找,而他开出的药方是多多支持科研,指望从中冒出像汽车那样的足以掀起大消费浪潮的大创新,

问题是:

1)有没有迹象显示,自70年代以来,美国企业的创新活动减少了,或创新激励减弱了?依我看,众多线索都指向相反方向,

2)何以认为这种增长模式转变是个需要治疗的毛病,因而需要你来开药方?更具体的说,当你对一国经济表现做长时段比较时,GDP增长率是不是恰当指标?如果GDP增长率放缓是社会富裕化的自然结果,那又有什么可担心的?

完全有可能,GDP这种特定的度量方法,会倾向于高估某些类型的福利改进,而低估另一些类型的福利改进,而后者在富裕社会的增长中占比更高(more...)

【2021-12-17】

现代经济中,存量有形资产的灭失成本相对整个经济体量来说是很小的,可以说微不足道,德国日本都被炸成那样了,没几年也就复苏了,所以,存量有形资产作为勒索筹码,至少在国际关系中的价值非常低,

对个体公司来说,价值略高一点,但也高不到哪儿去,特别是大型跨国公司,观察一下历史股价,火灾地震摧毁一家工厂,损失数字看起来不小,但对大公司的股价其实影响不大,所以,在跨国公司决定去留的问题上,存量有形资产作为勒索筹码也不会有多大用处,

真正管用的筹码是未来市场机会,这个筹码一直在起作用,但眼下可见两个苗头,一是筹码份量本身在缩减,二是跨国公司权衡天平的另一头,另一个份量重得多的筹码正在压上来,份量重到几乎无法抗拒——

国会对许多跨国公司脚踩两只船,两头吃好处的 do(more...)

【2021-11-18】

各国的长期增长走势是由波谷决定的,若把最近委内瑞拉的例子添进去,效果会更显著

(Douglass C. North & 《暴力与社会秩序》)

【2021-12-02】

@whigzhou: 比委内瑞拉更近的例子是埃塞俄比亚

【2021-04-23】

空间上的重组将是未来十年美国经济的一大景象,一些城市的治安状况正在向70年代水平回归,税基逃离,财政破产,将随之而来,

而且,在一段区间内,这一趋势非但不会被纠正,还会得到强化,因为部分人的逃离,只会提高当前台上政客的得票率,

美国历史上,类似的空间重组已发生过多次,原因各不相同,西进运动,水运向铁路的转变削弱了大河沿岸的优势,汽车导致的郊区化,州际公路网带来的分散化效果,空调普及成就了阳光地带,航空枢纽的影响,铁锈带的形成……

【2021-02-24】

一件有意思的事情,pandemic 曾经引起很多商品的短缺,可出人意料的是,它还造成了一次严重的硬币短缺,去年夏天开始,很多米国商家发现自己没有硬币用来找零了,去银行也换不到足够硬币,因为短缺是普遍的,不少商家脑筋还挺机灵,知道有个地方能换到硬币:投币洗衣店,于是大家都拿着纸币去机器上兑换,然后洗衣店们就不干了,派保安守着兑换机,只许真正的顾客换,可饶是如此,他们的硬币也很快耗尽了,因为来洗衣服的顾客中,自带硬币的比例似乎明显降低了,

这里有篇报道:

richmondfed.org/publications/research/econ_focus/2020/q4/federal_reserve

问题是,pandemic 让很多人(more...)

【2021-02-23】

经济史家里,除了加州学派那一窝之外,还有个名气很大却又特别垃圾的人,Robert Fogel,就是1993年和Douglass North分得诺奖的那位,当年让他一举成名的研究,是铁路对米国经济的影响,其结论可谓惊世骇俗:铁路的影响小到可以忽略,

看到这么颠覆性的结论,我很自然会以为,肯定有什么特别独到的方法揭示了某种隐藏特别深的事实吧,仔细一看,差点没把我隔夜饭喷出来,

结论怎么来的呢?他发明了一个概念叫社会节省(social savings),意思是,某一时(more...)

【2020-08-30】

18世纪大清经济最繁荣的地区(江南,广东,福建),工资率也最低,这可能是揭示马尔萨斯型增长(俗称内卷化)的一个最直接明了的量化指标,显示了这种繁荣是通过不断追加劳动投入(同时劳动生产率下降)的结果,这与西欧的情况恰好相反,在那里,最繁荣的北海地区,工资率也最高。(摘自Jan Luiten van Zanden《通往工业割命的漫长道路》第9章)

多年前我在《铁鎝与秧马》一文中也曾指出,劳动替代型工具在江南消失的最彻底,比如耕牛被铁鎝取代,马车被轿子取代,骡子被扁担取代……,这是内卷化的另一个指标

@eeskqiiq: 说好的江浙自古富裕呢[哼]

@whigzhou: 这跟富裕不矛盾,富的是那些靠非劳动资本吃饭的人,地租高,生意多,富人多,文化繁荣,这些都不假,而同时非熟练劳力报酬低,其生活水平更接近生存极限,这是传统经济创造繁荣的常规途径

@whigzhou: 历史上,斯密型增长和熊彼特型增长向来都是短期和局部的例外,直到工业革命

多年前我在《铁鎝与秧马》一文中也曾指出,劳动替代型工具在江南消失的最彻底,比如耕牛被铁鎝取代,马车被轿子取代,骡子被扁担取代……,这是内卷化的另一个指标

@eeskqiiq: 说好的江浙自古富裕呢[哼]

@whigzhou: 这跟富裕不矛盾,富的是那些靠非劳动资本吃饭的人,地租高,生意多,富人多,文化繁荣,这些都不假,而同时非熟练劳力报酬低,其生活水平更接近生存极限,这是传统经济创造繁荣的常规途径

@whigzhou: 历史上,斯密型增长和熊彼特型增长向来都是短期和局部的例外,直到工业革命

【2020-07-19】

@LIQUIDITY_NOTES @学经济家 1900以来各个国家前1%人群收入比重的数据,很有意思的是英语国家(美、英、加、澳、爱)都是U型走势;而欧洲大陆(法、西、荷、丹)和日本则呈现L型。

@学经济家: 以前金融资本视角系列长文中提过“里根-里甘-沃尔克节点”,视为划时代(金融视角里一战二战节点权重低于这个)。英语国家可视为超大市场(相比德日法语);全球投资的能力更强;对全球资本、精英还有富豪(以及官二代)的吸引力也更强。

(more...)【2019-10-20】

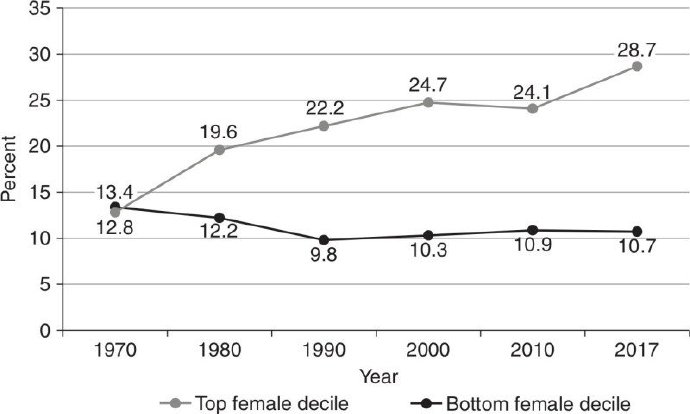

我觉得女性劳动参与率提高会降低阶层流动性,因为假如男性预期未来妻子是家庭妇女,择偶时就不会太在意其教育程度和潜在工资水平,反之,则会在这方面更assortative,从而提高阶层内婚比例,如图所示,工资收入Top10%的男性的配偶的工资收入也在Top10%里的比例自70年代以来一直在上升,同期女性劳动参与率也在提高,来源:How Assortative Mating Is Driving Income Inequality by Branko Milanovic

【2016-09-04】

该微博因被多人举报,根据《微博社区管理规定》,已被删除。

@whigzhou: 这也太牵强附会了,巴西走进口替代封闭经济,高关税培育国内制造业,最后被外债拖死,贵汁走三来一补外向型,贸易盈余多到撑,这个差别怎么强调都不过分,被原po直接无视

@whigzhou: 拉美和东亚滑向不同模式也事出有因,其中之一是劳动力禀赋差异,拉美平均智商比东亚低不止一个标准差,卖劳力没比较优势

@轻舟知寒:卖劳力为什么需要智商高?

@whigzhou: (more...)

Seattle’s Coming $15 Minimum Wage

西雅图即将实施15美元最低工资标准

作者:Clinton Alexander @ 2015-10-28

译者:沈沉(@你在何地-sxy)

校对:混乱阈值(@混乱阈值)

来源:The New American,www.thenewamerican.com/economy/economics/item/21844-seattles-coming-15-minimum-wage

In the city of Seattle, Washington, Joe Salvatore runs The Recycling Depot, a recycling business employing about 20 people. Not far away, Bobby Denovski is eking out a living at Padrino’s Pizza and Pasta with a handful of employees, and Remo Borracchini is busy running an Italian Bakery. The story is the same across Washington State and across the nation: Businesses are fighting every day to service customers, treat employees well, and simply stay open.

Joe Salvatore在华盛顿州西雅图市经营一家叫做“回收站”的回收企业,雇佣了大约20人。不远处,Bobby Denovski正惨淡经营着“帕记披萨和意粉”店,雇有少量员工。而Remo Borracchini则在为经营一家名为“意大利烘焙”的小店而上下奔波。这种故事在华盛顿州和整个美国都很普遍:为了服务顾客、善待雇员以及仅仅是保持开业,企业每天都在奋斗。

Unfortunately in the city of Seattle, it is about to get much more difficult for business owners to continue the fight. Pushed forward primarily by socialist city councilwoman Kshama Sawant, the first phase of a new minimum wage law went into effect on April 1, 2015, and the law will eventually bring all businesses to a $15 minimum wage, more than double the current federal minimum wage of $7.25 an hour.

不幸地是,在西雅图市,企业主想要继续奋斗下去,将来会变得更加艰难。主要由信奉社会主义的女市议员Kshama Sawant推动的新最低工资法已于2015年4月1日进入第一阶段的实施,并最终将对所有企业实行15美元最低工资标准,相当于将目前时薪7.25美元的联邦最低工资翻了一倍以上。

The law is a graduated system with different pay scales and timelines for businesses above and below 500 employees. For businesses with 501 employees or more, the April 1, 2015 minimum wage was set a(more...)

In economics, there is a principal called “zero sum gain” in which an increase is offset by a loss of equal amount. When a small business (and per the SBA’s size standards, over 99% of U.S. companies qualify as small) sees its operating costs increase, it has three options: 1) absorb the cost, 2) raise prices or 3) lower expenses. Since businesses don’t operate with the intention of losing money, the irony of a drastic increase in the minimum wage is that in order for employers to adjust, the net effect may be higher inflation and unemployment, disproportionately hurting the very same group the $15 minimum wage was intended to help. 在经济学中,有个原理叫做‘零和受益’,其中增加值被等量的损失所抵消。如果一家小企业(按照SBA的规模标准,美国超过99%的公司算小企业)的运营成本上升,它就面临三个选项:1)承担这一成本,2)提高价格,或者3)降低开支。由于企业运营的目的并不是为了损失金钱,所以最低工资急剧提升的反讽在于,雇主为了实现调整,最终净效果可能是通胀升高及失业率升高,这对于15美元最低工资标准意图帮助的那个群体损害相对更大。McLaughlin lays out three ways in which the new Seattle minimum wage law will play out as it’s implemented: a loss to the business owner (absorb the cost), a cost to the general public (raise prices), or a reduction in expenses (possible job loss). McLaughlin提出了西雅图最低工资新法实施之后最终将走向的三种路径:企业主出现损失(承担成本),一般公众的损失(提高价格),或者削减开支(可能出现工作岗位流失)。 A Loss to the Business Owner 企业主出现损失 For those people who have never run a business, the absorption of the additional cost may seem to be the easiest and most straightforward solution to the requirement to pay employees more. But contrary to what those who have never had the experience of sitting down with a company’s balance sheets might think, all business owners are not jet-setting CEOs with profits just flowing in. 对于从未经营过任何企业的人来说,为了达到支付雇员更高工资的要求,由企业承担额外成本似乎是最简单、最直接的解决办法。但与这些从未看过任何一个公司财务收支表的人所想的相反,并非所有企业主都是乘坐直升机的CEO,利润滚滚而来。 At The Recycling Depot, general manager Joe Salvatore stated, “What these people don’t take into consideration is that when you raise the wage, you’re raising the Labor and Industries Insurance cost because that amount is affected by the wages. I have already talked to several small businesses in the area and there’s not a single one who is making tons and tons of money where they’re just going to be able to absorb these costs.” “回收站”的总经理Joe Salvatore说,“这些人没有考虑到,如果提高工资,你还会提高劳动和工业保险成本,因为后者会受工资影响。我已经和本地区的数家小企业谈过,没有一家是在成吨成吨地赚钱,没有一家能够直接承担这些成本。” In other words, while the absorption of minor costs may be a normal and constant part of running a business, the bottom line is a major factor. At Padrino’s Pizza and Pasta, Bobby Denovski echoed Salvatore’s sentiment: “We aren’t a large company with huge profits. As a small business the cost of labor is one of the main factors. Fifteen dollars an hour, that’s a lot of money to ask from a small business.” 换句话说,尽管运营一家企业时,承受并消化小量的成本可能是个司空见惯、总在发生的事,但盈亏底线是个主要的因素。“帕记披萨和意粉”店的Bobby Denovski呼应了Salvatore的观点:“我们不是那种利润巨大的大公司。对于小企业来说,主要因素之一就是劳工成本。15美元一小时,这种要价对于小企业来说可是一大笔钱。” When asked what effect he could foresee the escalating minimum wage law having on his business, Denovski commented, “It could put us all out looking for jobs. We have a couple more years paying on the loan for our restaurant. If we end up paying this $15 an hour, we are honestly in danger of losing it.” 当被问及不断升级的最低工资法将来会对其生意产生何种影响时,Denovski评论说,“我们可能都会被迫出去找工作了。我们的餐馆还有几年贷款需要还。如果最终我们需要支付15美元的时薪,我们真的可能会失去餐馆。” Likewise, The Recycling Depot, as a metals recycling business, is subject to sometimes-dramatic market fluctuations. Metal values can skyrocket, allowing ample room to treat employees well, and values can plummet, leaving the business struggling to survive. Said Salvatore of the times when the market is up, “We do take care of our employees during those times. We give bonuses and things like that. However what about the lean times? This is going to have a dramatic effect on us during the lean times. You can’t just start taking the pay away.” 同样,从事金属回收生意的“回收站”也承受着市场波动,时不时还非常剧烈。金属价格可能飙升,此时企业就有足够的空间来更好对待员工,但价格也可能跳水,那样企业就只能竭力求生。谈及市场向好的时候,Salvatore说,“那种时候我们确实会照顾自己的员工。我们提供奖金等类似东西。但生意差的时候呢?在生意差的时候,这会给我们造成巨大的影响。减少支出都来不及。” A Cost to the General Public 一般公众的损失 If costs cannot be simply absorbed by the company, another option is to raise the price of the product. Bobby Denovski stated, “The only thing I can do is to raise the prices. I worry that the demand for pizza in the community will not support the prices we will have to go to when the wages go up.” How much is a pizza worth to those in his community? How about a gallon of milk? Those claiming the minimum wage will have no ill effect on the community should be asking themselves these questions, because at some point most small business owners such as Denovski must find a way to recoup these costs. 如果成本不能简单地由企业承担,还有一个选项就是提高产品价格。Bobby Denovski称,“我唯一能做就是提高价格。如果工资上涨,我们就必须抬高价位,我担心我所在社区的披萨需求不足以支持我们的这种要价。”在他的社区,一份披萨应该要价多少?一加仑牛奶呢?那些声称最低工资不会对社区产生不良影响的人应当问问自己这些问题,因为到了某个时候,绝大多数小企业主,如Denovski一样,都会想办法转移这些成本。 Referring again to fluctuating values in the metals market, Salvatore stated, “We’re very dependent on the global prices of metals. When the metal values drop, we’re making less money and our margins shrink. During times like this there are a lot of businesses just trying to stay afloat.” And so he is forced to try to pass on the costs in another manner. Salvatore再一次谈及金属市场的波动价格:“我们对全球金属价格有很大的依赖。金属价格下跌时,我们赚的钱就减少,利润收缩。碰到这种时候,大量的企业只是谋求维持下去。”所以他将被迫以另一种方式把成本传递出去。 As a metals recycling business, The Recycling Depot purchases metals from other businesses and from the general public, then sells those metals based on current market prices. Because Salvatore has no control over the sale price (dictated by global supply and demand), the only thing he can do is to drop the prices he is paying the public for those metals, illustrating the second point (a cost to the public) in another light. 从事金属回收行业的“回收站”从别的企业及一般公众手里收购金属,然后依照当前市场价格将这些金属卖出。由于Salvatore没有办法控制销售价格(它由全球供给和全球需求决定),他唯一能做的就是压低他支付给公众的金属收购价格,这从另一个方面说明了我们提出的第二点(公众的损失)。 Lower Expenses 降低开支 Absent the ability to absorb the higher wages or pass on the costs to someone else, a third way to compensate is to lower expenses. On the surface this sounds harmless enough. However, it often means the disappearance of jobs. 要是没有能力承担更高的工资或将成本传递给其他人,那么还有第三种弥补办法,那就是降低开支。表面看来这种做法相当无害。但是,它通常意味着工作岗位消失。 At Borracchini’s Bakery in Seattle, a business that has been open for 94 years, Remo Borracchini has a long history of hiring youth. “I myself have probably hired 1,500 young people over the years. I have had people come here as teenagers and stay here as much as 25 years, so they came and learned a trade,” said Borracchini. 西雅图的“博记烘焙”是一家已经开业94年的企业,店主Remo Borracchini 历来喜欢雇佣年轻人。“多年以来,我本人可能雇佣了1500个年轻人。我手下有些人,来的时候还是个少年,然后就在这工作了25年。他们来我这里,学会了一门生意”,Borrachini这样说道。 He has brought in high-school students who have never worked a job and started them washing pots and pans, stocking shelves, and mopping floors. While the wages many of these new hires make is not a large sum, Borracchini sees a bigger picture: 他曾招过一些从未干过任何工作的高中生,让他们从刷盘子洗碗、装货架、拖地开始干起。尽管这些新进员工所赚取的工资并不多,Borracchini看到的却是一幅更大的图景:

It’s not that we’re just looking for cheap labor. It’s the understanding that you’re doing something for these young people other than sending them out to wander aimlessly through the neighborhoods. You see, I do believe we have a responsibility to our young people. There used to be internships throughout industry. Now that has changed. 并不是说我们只是为了找些廉价劳工。我们的理解是,你是在帮这些年轻人做点什么事,没有让他们在社区中没头没脑地游窜。跟你说,我确实相信我们对年轻人负有责任。过去,各行各业都有实习。现在事情发生了变化。 They used to go into places like print shops, or bakeries and come to begin learning a trade; that was their reimbursement, they were learning something that would benefit them throughout their life. Now they’ve passed a law saying they have to be paid a wage. So what happens? If you’re going to have to pay someone who doesn’t know anything, you might as well pay someone who already knows something. 过去,他们要去文印店或面包店等类似地方,开始学习一门行当;那相当于他们的回报,他们是在学习某种将会受益终身的东西。现在有人制定一条法律,说是必须给他们支付工资。那会发生什么呢?如果有人啥都不懂,你也必须要支付他工资,那你还不如向那些懂点什么的人支付工资。Continued Borracchini, Borracchini继续说,

Businesses like McDonald’s, they built their empire not on a philosophy of it being a high paying job, but to take kids who have never worked before, teach them a little bit about work ethic and how to perform, and they move on to better opportunities when they have shown they have a bit of ability. You’ll begin to see the order screens in every type of McDonald’s scenario. Look at the jobs they’re eliminating right there. Kids who would be learning to show up for work on time, learning how to interact with the public, how to have a bit of work ethic. 像麦当劳这种企业帝国,它的建基哲学并不是它之作为一种高薪职位,而是它招募此前从未工作过的人,教给他们一点工作伦理和如何履职,然后当他们表现出具备一定能力时,就能前进一步,迈向更好的机会。以后你会看到各式各样的麦当劳式情景,大家都开始用点菜屏。看看他们正在消灭的工作。孩子们本来可以学会按时上班,学会如何与公众打交道,如何具备一点工作伦理。Salvatore echoed Borracchini, stating that in order to recoup labor costs, jobs would almost certainly be cut, “at least cutting hours back if not completely doing away with jobs. The well is not bottomless.” Salvatore呼应了Borrachini,并说,为了弥补劳工成本,工作岗位几乎肯定会被削减,“如果不是彻底废除岗位,至少需要减少雇佣时长。井中的水毕竟是有限的。” At Padrino’s, a clearly concerned Denovski stated, “Right now it’s [the minimum wage] at $11 an hour and it is already difficult for me and my partner to keep the bills paid and the employees paid. They’re going to be raising that expense up to $15, but none of our other costs will be going down. I honestly don’t know what we’re going to do.” “帕记”的Denovski明显很是担心,他说,“现在的最低工资是时薪11美元,而我和我的合伙人已经感到难以偿付账单、支付员工工资。他们还要将这一开支提高到15美元,而我们的其他成本都不会降低。我真的不知道我们有什么办法。” Salvatore then commented on a worst-case scenario, “Eventually we have to tighten the ropes, and then what happens when there’s nothing left in the reserve?” Indeed, what does happen? What happens to the low-skill workers looking for a job? Where will the teenager or young adult go for training when McDonald’s has automated order screens? As Borracchini said, “It is the internship and low-skill jobs which will be cut. We will have sent them back out onto the street.” 然后,Salvatore就最坏的情形作了评论,“最终我们必须拉紧裤腰带,如果没有剩下任何储备,那会发生什么呢?”确实,会发生什么呢?对于那些找工作的低技术工人,会发生什么呢?当麦当劳开始用自动点菜屏时,少年或刚刚成年的人们要去哪里接受训练?正如Borracchini所说,“被削减的会是那些实习岗位和低技术岗位。我们将不得不把他们送回街上。” Help or Harm? 帮助还是伤害? Seattle businesses obviously view the new minimum wage law with quite a bit of trepidation. It is easy to see why. These companies will have to find a way to recuperate the costs one way or another. No matter how it ends up happening, it will be a detriment to the community and the city. 西雅图的企业显然正以相当程度的恐惧看待最低工资新法。很容易发现原因所在。这些公司都必须寻找各种办法来弥补成本。不管最终会发生什么,它对于社区和整个城市都是一种损害。 In “The Tax & Budget Bulletin” by The Cato Institute dated March 2014, Joseph J. Sabia, associate professor of economics at San Diego State University, explains how a minimum wage affects the poor’s standard of living and employment opportunities: 在加图研究所2014年3月的“税收与预算简报”中,圣迭戈州立大学的经济学副教授Joseph J. Sabia就最低工资会如何影响穷人的生活水平和就业机会作出了解释:

The bulletin concludes that minimum wage increases almost always fail to meet proponents’ policy objectives and often hurt precisely the vulnerable populations that advocates wish to help. The weight of the science suggests that policymakers should abandon higher minimum wages as an antiquated anti-poverty tool. Minimum wages deter employment and are poorly targeted to those in need. 简报的结论是,提高最低工资几乎总是不能实现其支持者的政策目标,而且通常都会恰好伤害到鼓吹者们想要帮助的脆弱群体。科学表明,决策者们应当放弃提高最低工资这种早已过时的反贫困工具。最低工资伤害就业,而且对于身处困境的人们来说真是南辕北辙。His words echo the business owners quoted here. Says Borracchini, “I can sympathize with someone who is trying to raise a family. Fifteen dollars is not a lot of money. It’s very difficult. However, there is an element of society who through laws like this are being denied a great privilege. The opportunity to learn how to work.” 他的言论正与我们此处所引企业主的言论互相呼应。Borracchini说,“有人要努力养活一家人,这我能够同情。15美元并不是很大一笔钱。世事艰难。但是,通过这种法律,社会中有一部分人将无法享有一项重要的权利。那就是学会如何工作的机会。” The bottom line is that the minimum wage law was supposedly created to help the poor and needy in our society. However, it is the low-skill and poor who will feel the effect first and foremost, and who will find it much more difficult to acquire the job skills needed to raise the value of their labor to or above the minimum wage. 这里的底线是,最低工资法的创设,本意是为了帮助我们社会中的穷人和急需帮助的人群。但是,首当其冲感受到其影响的就是低技术人口和贫困人口,他们将发现,要将自己的劳动价值提高到或超过最低工资,就必须获得工作技能,而这将变得比以前更难。 As voices cry ever louder for an increased federal minimum wage, the stories of small businesses across the nation need to be brought into the spotlight — businesses reaching out to unskilled youth willing to put in time training. Companies managing a tight bottom line can’t handle the extra expense of yet another increase in wages. 随着提高联邦最低工资的呼声与日俱增,有必要将全美小企业的故事带到台前——这些企业都在向那些技能不足但愿意花时间接受训练的年轻人敞开双臂。盈亏底线很紧张的公司没有办法应对未来工资再次上涨所带来的额外开支。 The heart of our nation does not lie within the halls of Congress but rather in the bakeries, pizza shops, recycling centers, and myriad other small businesses. It is not in the backroom deals between politicians where the effects of these laws will be felt, but rather in the checking accounts of struggling businesses. 我们民族的心脏并不位于国会的办公大楼里,而是位于各家烘焙店、披萨店、回收中心以及种种其他小企业中。要感受到这些法律的效果,不是去看政客之间的暗箱交易,而需要去看艰难度日的各家企业的存款账户。 (编辑:辉格@whigzhou) *注:本译文未经原作者授权,本站对原文不持有也不主张任何权利,如果你恰好对原文拥有权益并希望我们移除相关内容,请私信联系,我们会立即作出响应。

——海德沙龙·翻译组,致力于将英文世界的好文章搬进中文世界——

【2016-05-24】

@whigzhou: 自由市场制度下,财产的初始分配根本不重要,整个宾夕法尼亚的土地起初全归小威廉·潘恩一人所有,这一事实对该州后来的社会结构有多大影响?彩票发明那么多年了,每年都有人中亿万大奖,你听说过哪个显贵家族是靠祖上中彩票发达的?

@whigzhou: 在《儿子照样升起》第15章里,Clark举了两项有关意外横财是否影响家庭长期命运的研究,结论都是:完全没有统计上可观察的正面影响。其中(more...)

【2016-05-08】

@吴军博士 发布了头条文章:里根可能是唯一一位能称得上是政治家的总统,1964年他在共和党大会上作了题为《抉择的时刻》,铿锵有力,掷地有声,从此一举成名。今天听起来,依然能够感受到一个保守主义者的卓实远见。全文如下: °里根1964年著名的讲演《抉择的时刻》 http://t.cn/Rqn1cnZ

@whigzhou: 这篇演讲其他都很好,我唯一不同意的是开头有关赤字和债务的观点,幸好里根上台后抛弃了这个立(more...)

“小小奇迹”不再:美国劳动收入占比下降

A Bit of a Miracle No More:The Decline of the Labor Share

作者:Roc Armenter @ 2015-三季刊

译者:Veidt(@Veidt)

校对:混乱阈值(@混乱阈值)

来源:Business Review,https://www.philadelphiafed.org/-/media/research-and-data/publications/business-review/2015/q3/brq315_a_bit_of_a_miracle_no_more.pdf

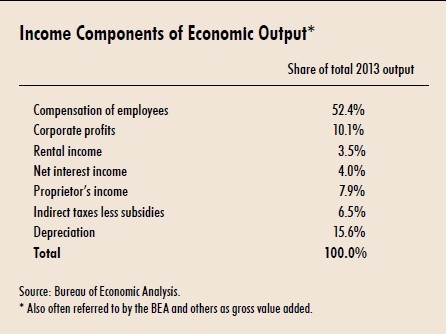

How is income divided between labor and capital? Every dollar of income earned by U.S. households can be classified as either labor earnings — wages and other forms of compensation — or capital earnings — interest or dividend payments and rent. The split between labor and capital income informs economists’ thinking on several topics and plays a key role in debates regarding income inequality and long-run economic growth. Unfortunately, distinguishing between labor and capital income is not always an easy task.

收入是如何在劳动和资本之间分配的?美国家庭所赚取的每一块钱都可以被归类为劳动收入(工资或其它形式的劳动补偿)或资本收益(利息、股利和租金等)。收入在劳动和资本之间的分配为经济学家们关于许多经济学议题的思考提供了重要信息,并且在关于收入不平等和长期经济增长这些问题的争论中扮演着核心角色。不幸的是,将劳动收入与资本收入区分开并非总是一件易事。

Until recently, the division between labor and capital income had not received much attention. The reason was quite simple: Labor’s share never ventured far from 62 percent of total U.S. income for almost 50 years — through expansions, recessions, high and low inflation, and the long transition from an economy primarily based on manufacturing to one mainly centered on services.

一直以来,区分劳动收入和资本收入的问题并没有受到太大关注,直到最近才有所改观。原因很简单:在将近50年中,美国劳动收入在总收入中所占的比例从来不会偏离62%这个数字太远——不论经济是在扩张还是衰退,也不论通胀率是高是低,在美国经济从以制造业为基础向主要以服务业为核心的漫长转变过程中,这个比例一直很稳定。

As it happened, the overall labor share remained stable as large forces pulling it in opposite directions canceled each other out — a coincidence that John Maynard Keynes famously called “a bit of a miracle.” But the new millennium marked a turning point: Labor’s share began a pronounced fall that continues today.

劳动收入占比在多种强大力量的反向拉扯和相互抵消之下总体保持了稳定这件事情本身——按照约翰·梅纳德·凯恩斯的著名说法——可以称得上是个“小小奇迹”。但是新千年的到来却标志着一个重要的转折点:劳动收入占比开始明显下降,并且这个趋势一直持续到了现在。

Why did the labor share lose its “miraculous” stability and embark on a steep decline? To investigate this shift, economists must first be sure they are measuring the labor share correctly. Could measurement problems distort our understanding of what has happened to the labor share over time?

为什么劳动收入占比会失去它“奇迹般”的稳定性而开始急剧下降?要研究这一转变,经济学家们的首要任务是确保他们测量劳动收入占比的方法是准确的。测量方法存在问题会歪曲我们对于长期以来劳动收入占比所发生的变化的理解吗?

In this article, I explain the inherent challenges in measuring the labor share and introduce several alternative definitions designed to address some of the measurement problems. As we will see, the overall trend is confirmed across a wide range of definitions.

在这篇文章中,我将解释在测量劳动收入占比时所面临的内在挑战,并介绍几种旨在解决其中一些测量问题的替代性定义。正如我们将看到的,基于一系列不同定义的测量结果都证实了劳动收入占比总体上的下降趋势。

Economists do not yet have a full understanding of the causes behind the labor share’s decline. We can make some progress, though, by noting the impact of wage and productivity trends and shifts between industries. Finally, I discuss several popular hypotheses, based on concurrent phenomena, such as widening wage inequality and globalization, that may account for the labor share’s sharp decline.

经济学家们至今还未能全面地理解劳动收入占比下降背后的原因。即便如此,通过研究工资和生产率的变化趋势以及产业的变迁,我们仍然可以取得一些进展。最后,我将讨论一些流行的假设。这些基于诸如薪资不平等程度加深以及全球化等并发现象的假设也许能解释劳动收入占比的急剧下降。

MEASURING THE U.S. LABOR SHARE

测量美国的劳动收入占比

By construction, all income accounted for in the U.S. economy must be earned either by capital or labor. In some cases, we can easily see whether our income comes from labor or capital: when we earn a wage or a bonus through our labor or when we earn interest from our savings or investment account, which is attributed to capital income, despite the fact that most of us would not think of ourselves as investors.

从定义上说,美国经济中任何的收入要么被资本赚取了,要么就是被劳动赚取了[i]。在一些情形中,我们可以很容易地看出我们的收入是来自于劳动还是资本:当我们通过劳动赚到一份工资或者奖金时,这部分收入显然来自于劳动;虽然我们中的大部分人并不认为自己是投资者,但当我们从储蓄或投资账户中获得利息或投资收益时,这部分收入很明显应该被归为资本收入。

However, it is not always immediately apparent that all income eventually accrues to either capital or labor. For example, when we buy our groceries — creating income for the grocer — we are only vaguely aware that we are also paying the producers, farm workers, and transporters as well as for the harvesters, trucks, trains, coolers, and other capital equipment involved in producing and distributing what we purchase. However, when the Bureau of Economic Analysis (BEA) constructs the national income and product accounts, it combines data from expenditures and income to ensure that every dollar spent is also counted as a dollar earned by either capital or labor.

然而,所有的收入最终都会被归为资本收入或劳动收入这一点并不总是那么显而易见。举个例子,当我们从杂货店里买东西时——这显然为杂货店主创造了收入——我们仅仅模糊地意识到我们所付的钱同样也为货物的生产者、农场工人、运输工人创造了收入,除此以外,我们还为投资于收割机、卡车、制冷装置和其它一些参与我们所购买货物的生产和分销过程的设备的资本创造了收入。而国家经济分析局(BEA)在构建国民收入和生产账户时将来自支出和来自收入的数据合并在一起,以保证任何一美元的支出也同样要么被资本赚取,要么被劳动赚取。

Of course, nothing is ever so simple economic statistics. First, we lack the detail necessary to split some components of the income data between labor and capital returns. As I (more...)

Proprietor’s income is defined as the income of sole proprietorships and partnerships — in other words, the income of self-employed individuals. There is no question that their income is the result of both labor and capital. For example, a freelance journalist may work long hours to document and write a story using a computer and a camera that she or he financed through savings. However, self-employed individuals have no need, economic or fiscal, to distinguish between wages and profits. However, economists do.

经营者收入被定义为个人独资以及合伙企业的收入——换句话说,也就是个体经营者的收入[iv]。毫无疑问,他们的收入同时是劳动投入和资本投入的结果。举例来说,一名自由记者可能会为了撰写一篇报导工作很长时间,而他使用的电脑和相机则是用自己的积蓄购买的。但是,个体经营者完全没有经济或财务上的理由将自己的收入区分为工资和利润。遗憾的是,经济学家们却需要这么做。

The main BLS measure

国家劳动统计局的主流测量方法

The BLS is well aware of these problems and goes to great lengths to disentangle proprietor’s income into its labor and capital income components. First, the BLS uses its data on payroll workers to compute an average hourly wage. The BLS then assumes that a self-employed worker would pay himself or herself the implicit wage rate. Then, using data on hours worked by self-employed workers, it obtains a measure of the labor compensation for self-employed individuals simply by multiplying the average hourly wage by the number of hours worked by the self-employed. The result is then assigned to labor income. The rest of the proprietor’s income is considered capital income.

国家劳动统计局对这些问题心知肚明,它在如何将经营者收入分解为劳动收入部分和资本收入部分这个问题上走得更远。首先,它使用领薪劳工的数据计算出一个平均时薪。然后假设一名自雇者将会按照这个时薪来给自己发工资。之后,使用自雇工人工作时长的数据并通过简单地将自雇者的平均时薪和工作时长相乘,国家劳动统计局就获得了对自雇者劳动报酬的测量数据。这个结果会被归为劳动收入,而这名经营者收入中的剩余部分则被认为是资本收入[v]。

Figure 1 plots the BLS’s headline labor share at an annual frequency from 1950 to 2013. Up until 2001, the labor share displayed some ups and downs, and perhaps a slight downward trend, but it never strayed far from 62 percent. From 2001 onward, though, the labor share has been steadily decreasing, dropping below 60 percent for the first time in 2004 and continuing its fall to 56 percent as of 2014.

图1描述了按国家劳动统计局主流方法计算出的自1950年到2013年的年度劳动收入占比[vi]。直到2001年,劳动收入占比一直都在一个很轻微的下行趋势中起起落落,但是它从来没有离62%这个数字太远。但自2001年以后,劳动收入占比一直在持续下降,在2004年首次跌破60%,并一直持续跌落到2014年的56%[vii]。

Proprietor’s income is defined as the income of sole proprietorships and partnerships — in other words, the income of self-employed individuals. There is no question that their income is the result of both labor and capital. For example, a freelance journalist may work long hours to document and write a story using a computer and a camera that she or he financed through savings. However, self-employed individuals have no need, economic or fiscal, to distinguish between wages and profits. However, economists do.

经营者收入被定义为个人独资以及合伙企业的收入——换句话说,也就是个体经营者的收入[iv]。毫无疑问,他们的收入同时是劳动投入和资本投入的结果。举例来说,一名自由记者可能会为了撰写一篇报导工作很长时间,而他使用的电脑和相机则是用自己的积蓄购买的。但是,个体经营者完全没有经济或财务上的理由将自己的收入区分为工资和利润。遗憾的是,经济学家们却需要这么做。

The main BLS measure

国家劳动统计局的主流测量方法

The BLS is well aware of these problems and goes to great lengths to disentangle proprietor’s income into its labor and capital income components. First, the BLS uses its data on payroll workers to compute an average hourly wage. The BLS then assumes that a self-employed worker would pay himself or herself the implicit wage rate. Then, using data on hours worked by self-employed workers, it obtains a measure of the labor compensation for self-employed individuals simply by multiplying the average hourly wage by the number of hours worked by the self-employed. The result is then assigned to labor income. The rest of the proprietor’s income is considered capital income.

国家劳动统计局对这些问题心知肚明,它在如何将经营者收入分解为劳动收入部分和资本收入部分这个问题上走得更远。首先,它使用领薪劳工的数据计算出一个平均时薪。然后假设一名自雇者将会按照这个时薪来给自己发工资。之后,使用自雇工人工作时长的数据并通过简单地将自雇者的平均时薪和工作时长相乘,国家劳动统计局就获得了对自雇者劳动报酬的测量数据。这个结果会被归为劳动收入,而这名经营者收入中的剩余部分则被认为是资本收入[v]。

Figure 1 plots the BLS’s headline labor share at an annual frequency from 1950 to 2013. Up until 2001, the labor share displayed some ups and downs, and perhaps a slight downward trend, but it never strayed far from 62 percent. From 2001 onward, though, the labor share has been steadily decreasing, dropping below 60 percent for the first time in 2004 and continuing its fall to 56 percent as of 2014.

图1描述了按国家劳动统计局主流方法计算出的自1950年到2013年的年度劳动收入占比[vi]。直到2001年,劳动收入占比一直都在一个很轻微的下行趋势中起起落落,但是它从来没有离62%这个数字太远。但自2001年以后,劳动收入占比一直在持续下降,在2004年首次跌破60%,并一直持续跌落到2014年的56%[vii]。

An alternative measure

一种替代测量方法

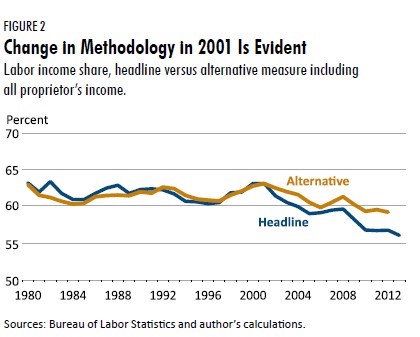

Michael Elsby, Bart Hobijn, and Aysegul Sahin have pointed out that some of the fall in the labor share in the past 15 years is due to how the BLS splits proprietor’s income. Indeed, until 2001, the BLS’s methodology assigned most of proprietor’s income to the labor share, a bit more than four-fifths of it. Since then, less than half of proprietor’s income has been classified as labor income.

Michael Elsby, Bart Hobijn和Aysegul Sahin指出,劳动收入占比在过去15年中的下降可部分归因于国家劳动统计局分割经营者收入的方法。事实也的确如此,直到2001年,国家劳动统计局都将经营者收入中的大部分归为劳动收入,比例略高于五分之四。而2001年之后,经营者收入中仅有不到一半的比例被归为劳动收入。

How important is this shift? It is fortunately very easy to produce an alternative measure of the labor share in which a constant fraction of proprietor’s income accrues to labor. Setting that fraction to its historical average prior to 2000 — 85 percent — we can figure out what would be the current labor share under this alternative assumption.

这一变化的影响有多大?幸运的是,我们可以很容易地用一种替代测量方法来对劳动收入占比进行估值,这种方法就是把业主收入按照一个固定比例计算为劳动收入。如果将该比例设定为2000年以前的历史平均值——85%——我们就能计算用该替代方法测量的当前的劳动收入占比。

Figure 2 contrasts the previous headline number against this alternative measure from 1980 onward.

图2对比了国家统计局公布的自1980年以来的劳动收入占比和使用替代方法得到的同时期劳动收入占比。

An alternative measure

一种替代测量方法

Michael Elsby, Bart Hobijn, and Aysegul Sahin have pointed out that some of the fall in the labor share in the past 15 years is due to how the BLS splits proprietor’s income. Indeed, until 2001, the BLS’s methodology assigned most of proprietor’s income to the labor share, a bit more than four-fifths of it. Since then, less than half of proprietor’s income has been classified as labor income.

Michael Elsby, Bart Hobijn和Aysegul Sahin指出,劳动收入占比在过去15年中的下降可部分归因于国家劳动统计局分割经营者收入的方法。事实也的确如此,直到2001年,国家劳动统计局都将经营者收入中的大部分归为劳动收入,比例略高于五分之四。而2001年之后,经营者收入中仅有不到一半的比例被归为劳动收入。

How important is this shift? It is fortunately very easy to produce an alternative measure of the labor share in which a constant fraction of proprietor’s income accrues to labor. Setting that fraction to its historical average prior to 2000 — 85 percent — we can figure out what would be the current labor share under this alternative assumption.

这一变化的影响有多大?幸运的是,我们可以很容易地用一种替代测量方法来对劳动收入占比进行估值,这种方法就是把业主收入按照一个固定比例计算为劳动收入。如果将该比例设定为2000年以前的历史平均值——85%——我们就能计算用该替代方法测量的当前的劳动收入占比。

Figure 2 contrasts the previous headline number against this alternative measure from 1980 onward.

图2对比了国家统计局公布的自1980年以来的劳动收入占比和使用替代方法得到的同时期劳动收入占比。

First, we confirm that through 2000, both the headline and the alternative measure pretty much coincide. Since 2001, though, they diverge, with the drop being noticeably smaller in the alternative measure. Indeed, this divergence suggests that at least one-third and possibly closer to half of the drop in the headline labor share is due to how the BLS treats proprietor’s income.

首先,我们确认直到2000年,按国家劳动统计局的主流方法和这里的替代方法得到的结果基本是吻合的。而自从2001年开始,两者之间的差异开始扩大。按替代方法计算的结果中,劳动收入占比的下降幅度明显要小得多。两者间的差异事实上表明,按国家经济统计局的主流方法计算所得的结果中至少三分之一,甚至很可能接近一半的劳动收入占比降幅是由该方法对待经营者收入的方式所引起的。

Alternatively, we can also proceed by the centuries-tested scientific method of ignoring the problem altogether and compute the compensation or payroll share instead of the labor share. That is, we can assume that none of proprietor’s income accrues to labor.

另外,我们还可以采用一种经过多个世纪检验的“科学方法”——彻底忽略以上不同测量方法的问题,仅仅计算受雇劳工获取的劳动报酬占比,而不计算劳动收入占比。那么,我们就可以假设,经营者的所有收入都不会被归为劳动收入。

This is actually a quite common approach, since detailed payroll data exist for all industries, allowing us to pinpoint which sectors of the economy are responsible for the dynamics of labor income. The compensation share is, obviously, lower than the labor share — but its evolution across time is very similar: stable until the turn of the millennium and a decline since then.

实际上这也是一种很常用的方法。由于所有的行业都有非常详细的工资单数据,这让我们能够详细地查明经济中的哪些部门对劳动收入的变化产生了影响。劳动报酬收入占总收入的比重显然要低于总的劳动收入,但是它随时间变化的轨迹与劳动收入占比的变化轨迹非常相似:在新千年到来之前一直都很稳定,而从那以后就开始持续下降。

Yet another measure

另一种替代测量方法

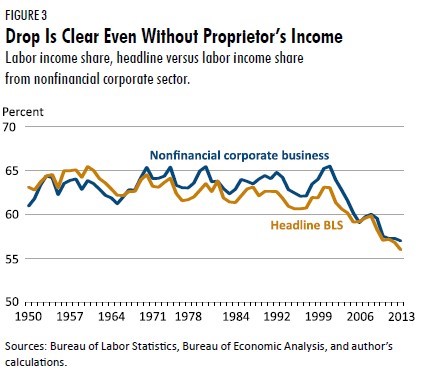

There is yet another possible way to circumvent the ambiguity regarding proprietor’s income. The data allow us to zoom in to the non-financial corporate business sector. By law, corporations must declare payroll and profits separately for fiscal purposes, so there is actually no proprietor’s income. The downside is, of course, that we are working with only a subset of the economy, albeit a very large one.

还有另外一种可能的方法可以绕过处理经营者收入时面临的模棱两可问题。数据让我们可以更仔细地观察非金融企业部门。在法律上,由于财务方面的原因,公司必须分开报告工资单和利润,因此实际上这里就不存在经营者收入这个概念。但这个方法的缺点在于,我们只能研究整体经济中的一个子集,尽管这是一个相当大的子集[viii]。

Figure 3 plots the BLS headline measure and the labor share of income of the non-financial corporate sector from 1950 to the latest data available. The two series overlap for most of the period, though the headline labor share was consistently about 1 percentage point below that of non-financial firms from 1980 onward. In any case, the message since 2000 is unmistakable: The large drop in the headline measure is fully reflected in this alternative measure.

图3描述了从1950年开始到最近可获取数据的时间段内,分别使用国家劳动统计局的主流方法和非金融企业部门的劳动收入占比数据所得到的结果。虽然自1980年开始,主流方法测得的的劳动收入占比相对非金融企业中的劳动收入占比一直都低了1%左右,但在大多数时间段内,两条曲线的走势都是趋同的。不论在哪种情形下,2000年以来的数据所传递的信号都是明确无误的:主流方法中劳动收入占比的巨大降幅在这种替代方法中也得到了完全的反映。

First, we confirm that through 2000, both the headline and the alternative measure pretty much coincide. Since 2001, though, they diverge, with the drop being noticeably smaller in the alternative measure. Indeed, this divergence suggests that at least one-third and possibly closer to half of the drop in the headline labor share is due to how the BLS treats proprietor’s income.

首先,我们确认直到2000年,按国家劳动统计局的主流方法和这里的替代方法得到的结果基本是吻合的。而自从2001年开始,两者之间的差异开始扩大。按替代方法计算的结果中,劳动收入占比的下降幅度明显要小得多。两者间的差异事实上表明,按国家经济统计局的主流方法计算所得的结果中至少三分之一,甚至很可能接近一半的劳动收入占比降幅是由该方法对待经营者收入的方式所引起的。

Alternatively, we can also proceed by the centuries-tested scientific method of ignoring the problem altogether and compute the compensation or payroll share instead of the labor share. That is, we can assume that none of proprietor’s income accrues to labor.

另外,我们还可以采用一种经过多个世纪检验的“科学方法”——彻底忽略以上不同测量方法的问题,仅仅计算受雇劳工获取的劳动报酬占比,而不计算劳动收入占比。那么,我们就可以假设,经营者的所有收入都不会被归为劳动收入。

This is actually a quite common approach, since detailed payroll data exist for all industries, allowing us to pinpoint which sectors of the economy are responsible for the dynamics of labor income. The compensation share is, obviously, lower than the labor share — but its evolution across time is very similar: stable until the turn of the millennium and a decline since then.

实际上这也是一种很常用的方法。由于所有的行业都有非常详细的工资单数据,这让我们能够详细地查明经济中的哪些部门对劳动收入的变化产生了影响。劳动报酬收入占总收入的比重显然要低于总的劳动收入,但是它随时间变化的轨迹与劳动收入占比的变化轨迹非常相似:在新千年到来之前一直都很稳定,而从那以后就开始持续下降。

Yet another measure

另一种替代测量方法

There is yet another possible way to circumvent the ambiguity regarding proprietor’s income. The data allow us to zoom in to the non-financial corporate business sector. By law, corporations must declare payroll and profits separately for fiscal purposes, so there is actually no proprietor’s income. The downside is, of course, that we are working with only a subset of the economy, albeit a very large one.

还有另外一种可能的方法可以绕过处理经营者收入时面临的模棱两可问题。数据让我们可以更仔细地观察非金融企业部门。在法律上,由于财务方面的原因,公司必须分开报告工资单和利润,因此实际上这里就不存在经营者收入这个概念。但这个方法的缺点在于,我们只能研究整体经济中的一个子集,尽管这是一个相当大的子集[viii]。

Figure 3 plots the BLS headline measure and the labor share of income of the non-financial corporate sector from 1950 to the latest data available. The two series overlap for most of the period, though the headline labor share was consistently about 1 percentage point below that of non-financial firms from 1980 onward. In any case, the message since 2000 is unmistakable: The large drop in the headline measure is fully reflected in this alternative measure.

图3描述了从1950年开始到最近可获取数据的时间段内,分别使用国家劳动统计局的主流方法和非金融企业部门的劳动收入占比数据所得到的结果。虽然自1980年开始,主流方法测得的的劳动收入占比相对非金融企业中的劳动收入占比一直都低了1%左右,但在大多数时间段内,两条曲线的走势都是趋同的。不论在哪种情形下,2000年以来的数据所传递的信号都是明确无误的:主流方法中劳动收入占比的巨大降幅在这种替代方法中也得到了完全的反映。

So, despite the inherent measurement problems, the data are clear: First, the labor share was stable from 1950 to at least near the end of the 1980s. Second, it has fallen precipitously since 2001. While the exact magnitude of the drop may be open to debate, there is no doubt that the downward trend in the labor share since 2001 is unprecedented in the data and, at the time of this writing, shows no signs of abating.

所以如果将这些测量方法所固有的问题放在一边,数据的含义是非常清晰的:首先,从1950年到至少1980年代末,劳动收入占比一直都保持了稳定。第二,从2001年开始,劳动收入占比开始急剧下降。虽然精确的降幅到底是多少仍然有待讨论,但毫无疑问的是,从数据看来,2001年之后的劳动收入占比下降趋势是前所未有的。而直到撰写本文时,这个趋势也丝毫也没有减弱的迹象。

A BIT OF A MIRACLE: 1950-1987

“小小奇迹”:1950-1987

We now take a closer look at the period in which the labor share was stable — roughly from the end of World War II to the late 1980s — by breaking it down by sector. In doing so, we will understand the logic behind the “bit of a miracle” quip. The cutoff date is necessarily 1987, since the industry classification changed in that year. Fortunately, it is also the approximate end date of the stable period for the labor share.

大约从二战结束一直到1980年代末这一时期的美国劳动收入占比一直都很稳定。现在我们来分阶段地仔细审视一下这个时期。这将有助理解这个“小小奇迹”背后的逻辑。我们只能将这一时期的终点选在1987年,因为在1987年,行业的划分标准发生了变化。幸运的是,这一年也恰好几乎是劳动收入占比保持稳定的时代终结的年份。

Since the end of WWII, the U.S. has gone through large structural changes to its sectorial composition. The most significant was the shift from manufacturing to services. In 1950, manufacturing accounted for more than two-thirds of the non-farm business sector. By 1987, manufacturing was just half of the non-farm business sector. Over the same period, services increased from 21 percent to 40 percent of the non-farm business sector.

自从二战结束后,美国经济的产业构成经历了巨大的结构性变化。最明显的变化是经济从制造业向服务业的转型。在1950年,制造业在非农经济中占据的比重超过了三分之二。而到1987年,制造业在非农经济中仅仅占据了一半的比重。同一时期,服务业在非农经济部门中所占的比重则从21%提升到了40%[ix]。

The reader would not be surprised to learn that different sectors use labor and capital in different proportions. In 1950, the manufacturing sector averaged a labor share of 62 percent, with some sub-sectors having even higher labor shares, such as durable goods manufacturing, with a labor share of 77 percent. Services instead relied more on capital and thus had lower labor shares: an average of 48 percent.

对于不同的经济部门中劳动和资本的构成比例不同这一点,相信读者们并不会感到吃惊。在1950年,制造业部门中的平均劳动收入占比是62%,而其中某些子部门的劳动收入占比还要更高,例如在耐用品制造业中,劳动收入占比到了77%[x]。与之相反,服务业则更加依赖于资本,因而其劳动收入占比也更低:平均水平是48%。

Thus, from 1950 to 1987, the sector with a high labor share (manufacturing) was cut in half, while the sector with a low labor share (services) doubled. The aggregate labor share is, naturally, the weighted average across these sectors. Therefore, we would have expected the aggregate labor share to fall. But as we already know, it did not.

也就是说,从1950年到1987年间,劳动收入占比较高的部门(制造业)在经济中的占比下降了接近一半,而劳动收入占比较低的部门(服务业)在经济中的占比则上升了一倍。加总的劳动收入占比很自然地应该等于不同部门劳动收入占比的加权平均值。既然如此,我们应该可以预期,加总的劳动收入占比会下降。但正如我们已经知道的,它并没有下降。

The reason is that, coincidentally with the shift from manufacturing to services, the labor share of the service sector rose sharply, from 48 percent in 1950 to 56 percent in 1987. Education and health services went from labor shares around 50 percent to the highest values in the whole economy, close to 84 percent. In manufacturing, the labor share was substantially more stable, increasing by less than 2 percentage points over the period.

而其中的原因则是在经济从制造业向服务业的转型过程中,服务业中的劳动收入占比却巧合地经历了大幅的上升,从1950年的48%上升到了1987年的56%。教育和医疗服务业中的劳动收入占比从50%左右上升到了整个经济各部门中的最高水平,接近84%[xi]。制造业中的劳动收入占比则持续保持稳定,在整个期间内上升了不到2%。

And this is the “bit of a miracle” — that the forces affecting the labor share across and within sectors just happened to cancel each other out over a period of almost half a century.

而这就是所谓的“小小奇迹”——在接近半个世纪的时间内,部门间和部门内影响劳动收入占比的各种力量恰恰抵消了各自的影响。

A BIT OF A MIRACLE NO MORE: 1987-2011

“小小奇迹”不再:1987-2011

I start by repeating the previous exercise, now over the period 1987 to 2011. As it had from 1950 to 1987, the manufacturing sector kept losing ground to the service sector, albeit at a slower rate.

下面我首先会采取和之前相同的方法来分析美国经济的劳动收入占比,只是将时间段换成1987年-2011年。和1950年-1987年间一样,尽管速度有所下降,但制造业部门在经济中的占比仍然持续被服务业部门所抢占。

By 2011, services accounted for more than two-thirds of U.S. economic output and an even larger fraction of total employment. However, the differences in the labor share between the two sectors were much smaller by the early 1990s, and thus the shift from manufacturing to services had only small downward effects on the overall labor share.

到2011年,服务业在美国经济总产出中所占的比重已经超过了三分之二,而在总就业中的占比甚至更高。然而这两个部门之间劳动收入占比的差异相比1990年代初却缩小了不少,因此,经济从制造业向服务业的转型对总体劳动收入占比仅仅会造成很小的下行作用。

We readily find out which part of the economy is behind the decline of the labor share once we look at the change in the labor share within manufacturing, which dropped almost 10 percentage points. Virtually all the major manufacturing sub-sectors saw their labor shares fall; for non-durable goods manufacturing it dropped from 62 percent to 40 percent. The labor share within the service sector kept increasing, as it had before 1987, but very modestly, only enough to cancel the downward pressure from the shift across sectors. Indeed, had the labor share of income in manufacturing stayed constant, the overall labor share would have barely budged.

只要看看在制造业中劳动收入占比的变化,我们就能很容易地发现经济中的哪一部分是造成劳动收入占比下降的主因。在制造业中,劳动收入占比下降了接近10个百分点。基本上所有主要的制造业子部门都经历了劳动收入占比的下降。在非耐用品制造业中,劳动收入占比从62%下降到了40%。而服务业部门的劳动收入占比相对1987年之前的水平仍然保持了增长,但是增幅非常缓慢,仅仅足够抵消掉由经济从制造业向服务业转型所产生的下行压力。的确,假如制造业中的劳动收入占比能够保持不变,整体经济中的劳动收入占比就几乎不会下降。

Note that in one sense, the bit of a miracle actually continued from 1987 onward: As manufacturing continued to shrink, decreasing the share of income accruing to labor, services picked up the slack by increasing their share of income accruing to labor, albeit more modestly than before. What ended the “miracle” was the precipitous decline in the labor share within manufacturing.

从这个意义上说,“小小奇迹”实际上在1987年之后也得到了延续:制造业在整体经济中占比的持续收缩减少了总收入中劳动收入的比例,而服务业则在一定程度上通过提升部门内的劳动收入占比收拾了残局,虽然提升的速度相比之前已经减缓了许多。终结“奇迹”的实际上是制造业内部劳动收入占比的急剧下降。

Wages and productivity

工资与劳动生产率

It is worth investigating a bit further what determinants are behind the fall in the labor share within manufacturing, since it played such an important role in the decline of the overall labor share. To this end, note that the change in the labor share in a particular sector is linked to the joint evolution of wages and labor productivity.

由于制造业内部的劳动收入占比下降在整体劳动收入占比的下降中发挥了如此重要的作用,更深入地研究其中的决定因素就显得很有价值了。从这个意义上说,我们需要注意到,某个特定部门内的劳动收入占比是与工资和劳动生产率的联合演化联系在一起的。

Consider a machine operator working in a factory for one hour to produce goods that will have a gross value to the factory owner of $100. If he is paid $60 per hour, labor’s share is approximately 60 percent. For the labor share to change, there are only two possibilities: Either the value of the goods produced must change or the hourly wage must. Conversely, for the labor share to stay constant, the value of the goods and the hourly wage have to move in unison.

假如一名机器操作员在工厂中工作一小时能够生产出对于工厂主而言价值100美元的产品,如果他的时薪是60美元,那么劳动收入占比就大约是60%。一旦劳动收入占比发生变化,仅仅有两种可能的情况:要么是产出的价值发生了变化,要么是操作员的时薪发生了变化。反过来说,如果劳动收入占比保持不变,产出的价值和操作员的时薪就必须总是等比例变化[xii]。

So which one — productivity or wages — brought down the labor share in manufacturing? Fortunately, we do have reliable data on output, wage rates, and hours worked in manufacturing. Figure 4 displays the evolution of labor productivity (that is, output per hour) and wage rates from 1950 onward. Both series are set such that their value in 1949 equals 100.

那么在生产率和工资水平中,究竟是哪一项将制造业中的劳动收入占比拖了下来呢?幸运的是,我们拥有制造业中关于产出,单位时间工资和工作时长的可靠数据。图4显示了自1950年以来劳动生产率(也就是每小时产出)和单位时间工资的演化过程[xiii]。两条曲线都将1949年的水平设定为100[xiv]。

So, despite the inherent measurement problems, the data are clear: First, the labor share was stable from 1950 to at least near the end of the 1980s. Second, it has fallen precipitously since 2001. While the exact magnitude of the drop may be open to debate, there is no doubt that the downward trend in the labor share since 2001 is unprecedented in the data and, at the time of this writing, shows no signs of abating.

所以如果将这些测量方法所固有的问题放在一边,数据的含义是非常清晰的:首先,从1950年到至少1980年代末,劳动收入占比一直都保持了稳定。第二,从2001年开始,劳动收入占比开始急剧下降。虽然精确的降幅到底是多少仍然有待讨论,但毫无疑问的是,从数据看来,2001年之后的劳动收入占比下降趋势是前所未有的。而直到撰写本文时,这个趋势也丝毫也没有减弱的迹象。

A BIT OF A MIRACLE: 1950-1987

“小小奇迹”:1950-1987

We now take a closer look at the period in which the labor share was stable — roughly from the end of World War II to the late 1980s — by breaking it down by sector. In doing so, we will understand the logic behind the “bit of a miracle” quip. The cutoff date is necessarily 1987, since the industry classification changed in that year. Fortunately, it is also the approximate end date of the stable period for the labor share.

大约从二战结束一直到1980年代末这一时期的美国劳动收入占比一直都很稳定。现在我们来分阶段地仔细审视一下这个时期。这将有助理解这个“小小奇迹”背后的逻辑。我们只能将这一时期的终点选在1987年,因为在1987年,行业的划分标准发生了变化。幸运的是,这一年也恰好几乎是劳动收入占比保持稳定的时代终结的年份。

Since the end of WWII, the U.S. has gone through large structural changes to its sectorial composition. The most significant was the shift from manufacturing to services. In 1950, manufacturing accounted for more than two-thirds of the non-farm business sector. By 1987, manufacturing was just half of the non-farm business sector. Over the same period, services increased from 21 percent to 40 percent of the non-farm business sector.

自从二战结束后,美国经济的产业构成经历了巨大的结构性变化。最明显的变化是经济从制造业向服务业的转型。在1950年,制造业在非农经济中占据的比重超过了三分之二。而到1987年,制造业在非农经济中仅仅占据了一半的比重。同一时期,服务业在非农经济部门中所占的比重则从21%提升到了40%[ix]。

The reader would not be surprised to learn that different sectors use labor and capital in different proportions. In 1950, the manufacturing sector averaged a labor share of 62 percent, with some sub-sectors having even higher labor shares, such as durable goods manufacturing, with a labor share of 77 percent. Services instead relied more on capital and thus had lower labor shares: an average of 48 percent.

对于不同的经济部门中劳动和资本的构成比例不同这一点,相信读者们并不会感到吃惊。在1950年,制造业部门中的平均劳动收入占比是62%,而其中某些子部门的劳动收入占比还要更高,例如在耐用品制造业中,劳动收入占比到了77%[x]。与之相反,服务业则更加依赖于资本,因而其劳动收入占比也更低:平均水平是48%。

Thus, from 1950 to 1987, the sector with a high labor share (manufacturing) was cut in half, while the sector with a low labor share (services) doubled. The aggregate labor share is, naturally, the weighted average across these sectors. Therefore, we would have expected the aggregate labor share to fall. But as we already know, it did not.

也就是说,从1950年到1987年间,劳动收入占比较高的部门(制造业)在经济中的占比下降了接近一半,而劳动收入占比较低的部门(服务业)在经济中的占比则上升了一倍。加总的劳动收入占比很自然地应该等于不同部门劳动收入占比的加权平均值。既然如此,我们应该可以预期,加总的劳动收入占比会下降。但正如我们已经知道的,它并没有下降。

The reason is that, coincidentally with the shift from manufacturing to services, the labor share of the service sector rose sharply, from 48 percent in 1950 to 56 percent in 1987. Education and health services went from labor shares around 50 percent to the highest values in the whole economy, close to 84 percent. In manufacturing, the labor share was substantially more stable, increasing by less than 2 percentage points over the period.

而其中的原因则是在经济从制造业向服务业的转型过程中,服务业中的劳动收入占比却巧合地经历了大幅的上升,从1950年的48%上升到了1987年的56%。教育和医疗服务业中的劳动收入占比从50%左右上升到了整个经济各部门中的最高水平,接近84%[xi]。制造业中的劳动收入占比则持续保持稳定,在整个期间内上升了不到2%。

And this is the “bit of a miracle” — that the forces affecting the labor share across and within sectors just happened to cancel each other out over a period of almost half a century.

而这就是所谓的“小小奇迹”——在接近半个世纪的时间内,部门间和部门内影响劳动收入占比的各种力量恰恰抵消了各自的影响。

A BIT OF A MIRACLE NO MORE: 1987-2011

“小小奇迹”不再:1987-2011

I start by repeating the previous exercise, now over the period 1987 to 2011. As it had from 1950 to 1987, the manufacturing sector kept losing ground to the service sector, albeit at a slower rate.

下面我首先会采取和之前相同的方法来分析美国经济的劳动收入占比,只是将时间段换成1987年-2011年。和1950年-1987年间一样,尽管速度有所下降,但制造业部门在经济中的占比仍然持续被服务业部门所抢占。

By 2011, services accounted for more than two-thirds of U.S. economic output and an even larger fraction of total employment. However, the differences in the labor share between the two sectors were much smaller by the early 1990s, and thus the shift from manufacturing to services had only small downward effects on the overall labor share.

到2011年,服务业在美国经济总产出中所占的比重已经超过了三分之二,而在总就业中的占比甚至更高。然而这两个部门之间劳动收入占比的差异相比1990年代初却缩小了不少,因此,经济从制造业向服务业的转型对总体劳动收入占比仅仅会造成很小的下行作用。

We readily find out which part of the economy is behind the decline of the labor share once we look at the change in the labor share within manufacturing, which dropped almost 10 percentage points. Virtually all the major manufacturing sub-sectors saw their labor shares fall; for non-durable goods manufacturing it dropped from 62 percent to 40 percent. The labor share within the service sector kept increasing, as it had before 1987, but very modestly, only enough to cancel the downward pressure from the shift across sectors. Indeed, had the labor share of income in manufacturing stayed constant, the overall labor share would have barely budged.

只要看看在制造业中劳动收入占比的变化,我们就能很容易地发现经济中的哪一部分是造成劳动收入占比下降的主因。在制造业中,劳动收入占比下降了接近10个百分点。基本上所有主要的制造业子部门都经历了劳动收入占比的下降。在非耐用品制造业中,劳动收入占比从62%下降到了40%。而服务业部门的劳动收入占比相对1987年之前的水平仍然保持了增长,但是增幅非常缓慢,仅仅足够抵消掉由经济从制造业向服务业转型所产生的下行压力。的确,假如制造业中的劳动收入占比能够保持不变,整体经济中的劳动收入占比就几乎不会下降。

Note that in one sense, the bit of a miracle actually continued from 1987 onward: As manufacturing continued to shrink, decreasing the share of income accruing to labor, services picked up the slack by increasing their share of income accruing to labor, albeit more modestly than before. What ended the “miracle” was the precipitous decline in the labor share within manufacturing.

从这个意义上说,“小小奇迹”实际上在1987年之后也得到了延续:制造业在整体经济中占比的持续收缩减少了总收入中劳动收入的比例,而服务业则在一定程度上通过提升部门内的劳动收入占比收拾了残局,虽然提升的速度相比之前已经减缓了许多。终结“奇迹”的实际上是制造业内部劳动收入占比的急剧下降。

Wages and productivity

工资与劳动生产率

It is worth investigating a bit further what determinants are behind the fall in the labor share within manufacturing, since it played such an important role in the decline of the overall labor share. To this end, note that the change in the labor share in a particular sector is linked to the joint evolution of wages and labor productivity.

由于制造业内部的劳动收入占比下降在整体劳动收入占比的下降中发挥了如此重要的作用,更深入地研究其中的决定因素就显得很有价值了。从这个意义上说,我们需要注意到,某个特定部门内的劳动收入占比是与工资和劳动生产率的联合演化联系在一起的。

Consider a machine operator working in a factory for one hour to produce goods that will have a gross value to the factory owner of $100. If he is paid $60 per hour, labor’s share is approximately 60 percent. For the labor share to change, there are only two possibilities: Either the value of the goods produced must change or the hourly wage must. Conversely, for the labor share to stay constant, the value of the goods and the hourly wage have to move in unison.

假如一名机器操作员在工厂中工作一小时能够生产出对于工厂主而言价值100美元的产品,如果他的时薪是60美元,那么劳动收入占比就大约是60%。一旦劳动收入占比发生变化,仅仅有两种可能的情况:要么是产出的价值发生了变化,要么是操作员的时薪发生了变化。反过来说,如果劳动收入占比保持不变,产出的价值和操作员的时薪就必须总是等比例变化[xii]。

So which one — productivity or wages — brought down the labor share in manufacturing? Fortunately, we do have reliable data on output, wage rates, and hours worked in manufacturing. Figure 4 displays the evolution of labor productivity (that is, output per hour) and wage rates from 1950 onward. Both series are set such that their value in 1949 equals 100.

那么在生产率和工资水平中,究竟是哪一项将制造业中的劳动收入占比拖了下来呢?幸运的是,我们拥有制造业中关于产出,单位时间工资和工作时长的可靠数据。图4显示了自1950年以来劳动生产率(也就是每小时产出)和单位时间工资的演化过程[xiii]。两条曲线都将1949年的水平设定为100[xiv]。

Once again we see two clearly separate periods. Until the early 1980s, labor productivity and wages grew at a very similar rate — if anything, the wage rate out-paced productivity, which, as described earlier, implies that the labor share in manufacturing inched up. By mid-1985, labor productivity took off, while wage growth was very sluggish. Since then, the gap between productivity and wages has kept growing, depressing the labor share.

我们又一次地看到了两个被明显分隔开的时期。直到上世纪80年代早期,劳动生产率和工资都一直在以很接近的速度增长——如果有不同的话,也是工资的增长速度超过了劳动生产率。按照之前的描述,这意味着制造业中的劳动收入占比提高了。到上世纪80年代中期,劳动生产率开始突飞猛进,而工资的增长则变得非常缓慢。从那以后,劳动生产率和工资之间的差距就开始持续扩大,从而不断压低劳动收入占比。

Because an index is used to scale both series, it is a tad difficult to grasp from the figure whether labor productivity accelerated or wage rates stagnated from the 1980s onward. The answer is both things happened. In the 1980s, productivity grew at about its long-term trend rate, but wages were virtually flat, growing less than half a percentage point a year on average over the decade. Wage growth recovered in the 1990s, but productivity actually took off, further increasing the gap. Overall, though, it appears that the fall in the labor share is explained mainly by the sluggish growth of wages rather than above-trend labor productivity.

由于我们使用同一个坐标来衡量两条曲线的变化,想要从图中分辨出1980年后究竟是劳动生产率的增长加速了还是单位时间工资的增长停滞了似乎有些困难。答案是两件事情都发生了。在1980年代,劳动生产率的增长速度基本上等于它的长期平均增长率,但是工资增长则相当平缓,这十年中的年均增长率不到0.5%。工资的增长在1990年代有所恢复,但是生产率的增长则突飞猛进,让两者间的差距越来越大。但是整体看来,劳动收入占比的下降更为主要的原因还是缓慢的工资增长速度,而不是增长的劳动生产率。

CONCURRENT PHENOMENA

一些并发的现象

What is the ultimate cause behind the decline of the labor share in the U.S.? The honest answer is that economists have several hypotheses but no definite answer yet. Rather than go over the sometimes-intricate theories behind these hypotheses, I will discuss the main observation or phenomenon anchoring each one.

美国劳动收入占比下降背后的终极原因到底是什么?诚实的回答是,经济学家们目前只是提出了一些假说,但还没有得到确定的答案[xv]。在本文中,我并不准备把这些假说背后的那些有时看起来错综复杂的理论复述一遍,而将讨论与每个假说相关的主要观察结果或现象。

Capital deepening

资本深化

This is by far the most popular hypothesis: Workers have been replaced by equipment and software. Who has not seen footage of robots working an auto assembly line? Older readers may remember when live tellers and not ATMs dispensed cash at banks. Software is now capable of piloting planes and, even more amazingly, doing our taxes!

这是至今为止最流行的假说:工人正在不断地被设备和软件所替代。今天谁还没有见过机器人在汽车流水线上的身影呢?年纪大一些的读者们可能还记得,在过去银行是使用出纳员而不是ATM机来分发现金的。当时的软件还不具备为飞机导航的能力,而更令今人惊讶的是,它们甚至还无法计算我们的税单!

There is more behind this hypothesis than anecdotes. Loukas Karabarbounis and Brent Neiman document a fall in equipment prices. Lawrence Summers proposes that capital should be viewed as at least a partial substitute for labor — more and more so as technology develops. In both models, the idea is similar: Better or cheaper equipment replaces workers and redistributes income from labor to capital. The result is that production becomes more intensive in capital, which is why these theories are often referred to as capital deepening.

这个假说背后有着远比这些旧日轶闻深刻得多的内容。Loukas Karabarbounis和Brent Neiman证明了设备价格的下降趋势。Lawrance Summers则提出,资本至少应该被看作劳动力的一种部分替代——而随着技术的发展,替代的程度也越来越高。在这两个模型中,观点是相似的:更好或者更便宜的设备替代了工人的劳动,并且将之前属于劳动的一部分收入重新分配给了资本。结果就是生产过程的资本密集程度越来越高,这也是这些理论通常被人们称为“资本深化”的原因。

It is important to understand that the capital deepening mechanism must operate at the level of the overall economy. So, when we see a robot replace, say, five workers, we need to remember that the production of the robot itself involved workers, so we are swapping auto assemblers with robot assemblers. It is, of course, still possible that the robot tilts income toward capital, but it is not a foregone conclusion.

重要的是,我们必须懂得资本深化机制只有在整体经济的尺度上才能发挥作用。所以当我们看到一个机器人替代了5名工人时,我们应该记住,机器人的生产本身也需要工人,所以我们只是把汽车装配工换成了机器人装配工而已。当然,机器人的确很有可能会让收入的天平向资本倾斜,但这并非已成定局。

The main challenge to capital deepening is that if a sector is substituting robots for workers to save money or improve the quality of the good being produced, the remaining workers should therefore become more productive and, overall, the sector should be expanding. In other words, capital deepening can reduce the labor share of income, but it does so by making labor productivity accelerate rather than making wages stagnate. As we saw earlier, this does not fit the actual picture of the manufacturing sector at all.

对资本深化理论的主要挑战是,如果某个部门通过使用机器人代替工人来节省成本或者提高所生产的产品质量,那么剩下的工人的生产效率就应该变得更高,而在整体上,这个部门应该会在扩张之中。换句话说,资本深化会降低劳动在总收入中所占的比例,但这是通过让劳动生产率获得提升来完成的,而不是让工资的增长停滞。就像我们之前所看到的,这与制造业所呈现的实际图景完全不相符[xvi]。

Income inequality

收入不平等

The increase in income inequality in the U.S. has lately received a lot of attention. The decline of the labor share is a force toward income inequality because capital is more concentrated across households than labor is.

最近,美国收入不平等的加剧获得了大量的关注。劳动收入占比下降显然是一种加剧收入不平等的力量,因为相比劳动力,资本在家庭间的分布集中度显然更高[xvii]。

It should be noted, though, that the main driver of the increase in income inequality is not capital income but rather wages themselves, particularly at the very top of the pay ladder. As Elsby and his coauthors document, the increase in top wages has actually sustained the labor share. In other words, the decline in the labor share actually understates the increase in income inequality.

但值得一提的是,收入不平等加剧的主要驱动力并不是资本收入,而是工资收入本身,尤其是在工资收入阶梯的顶端[xviii]。正如Elsby和他的合作者们所证明的,顶端工资的增长实际上会起到维持劳动收入占比的作用。换句话说,劳动收入占比的下降实际上还低估了收入不平等程度的加剧。

An interesting question is whether whatever is driving up inequality is also driving down the labor share. Several economists have proposed that technological change is skill biased — that is, it augments productivity more for highly skilled workers than for low-skilled workers. Combined with the idea that capital helps highly skilled workers be more productive but makes unskilled workers redundant, skill bias can explain both the increase in wage inequality and the decline in the labor share.

一个有趣的问题是,任何加剧收入不平等程度的因素是否也同样会降低劳动收入占比呢?一些经济学家提出,技术进步对于工人技能的影响是有偏的——也就是说,相对于低技能的工人,技术进步会更大地提升那些高技能工人的生产力。与之前得出的资本在帮助高技能工人提高生产力同时,让低技能工人变得冗余的观点相结合,“技能偏好”能够同时解释工资收入不平等程度的加剧和劳动收入占比的降低[xix]。

Let us return once more to the car manufacturer example. The robot may be replacing five unskilled workers but may require a qualified operator. The demand for unskilled workers falls, and so do their wages; but the demand for qualified operators increases, and so do their wages. So it is possible to have an increase in wage inequality while factories undergo capital deepening.

让我们再次回到汽车制造商的例子。机器人可能会替代掉5名不熟练的工人,但同时却会需要一名合格的操作员。对不熟练工人的需求下降了,他们的工资收入也会同时下降;但是对合格的操作员的需求和他们的工资水平则会同步提升。所以随着工厂经历资本深化的过程,工资收入的不平等程度也很可能会加剧。

Globalization.

全球化

Another popular hypothesis links the fall in the labor share with the advent of international trade liberalization. There is no question that there has been a substantial increase in trade by U.S. firms in the past few decades. In particular, firms have shifted parts of their production processes to foreign countries to take advantage of cheaper inputs — which, from the perspective of a country like the U.S. that has more capital than other countries, means cheap labor. Industries that are more intensive in labor, such as manufacturing, will be more likely to outsource their production processes abroad, and thus the remaining factories are likely to be the ones that rely more on capital.

另一个流行的假说将劳动收入占比的下降与国际贸易自由化的出现联系在了一起。毫无疑问,在过去的几十年中,美国公司所进行的国际贸易经历了非常显著的增长。尤其值得一提的是,许多美国公司都将它们的一部分生产流程转移到了国外以利用更加便宜的生产要素——对于美国这样一个比他国拥有更多资本的国家来说,也就是劳动力。劳动力更加密集的那些行业,例如制造业,将更有可能将生产流程外包到国外,而那些留在国内的工厂则更可能属于那些对资本依赖程度较高的行业。

Surprisingly, there is not a lot of evidence to support this view. The main challenge to the hypothesis is that U.S. exports and imports are very similar in their factor composition. That is, were trade driving down the labor share, we would observe the U.S. importing goods that use a lot of labor and exporting goods that use a lot of capital. Instead, most international trade involves exchanging goods that are very similar, such as cars.

令人吃惊的是,并没有多少证据能够支持这个观点。这一假说所面临的主要挑战是,美国的进口和出口在要素构成上其实非常相似。也就是说,如果说国际贸易降低了美国的劳动收入占比,那么我们会观察到美国所进口的产品的生产要素中包含大量的劳动,而出口产品的生产要素中则包含大量的资本。但实际上,大多数的国际贸易中所交换的产品都非常相似,例如汽车[xx]。

Another prediction of the globalization theory is that countries the U.S. exports to should see their labor shares increase and — as noted in the accompanying discussion, it appears that the decline in the labor share is a global phenomenon.

支持全球化降低了美国劳动收入占比的理论所作出的另一项预测是,那些从美国进口多于向美国出口的国家的劳动收入占比应该会上升——而我们在之前的讨论中已经提到过,劳动收入占比下降似乎是一个全球性的现象。

Some studies, though, do support this hypothesis. Elsby and his coauthors find some evidence that the labor share fell more in sectors that were more exposed to imports. There is a large body of literature on the impact of trade on wage inequality that only recently has started to consider the impact on the labor share.

事实上,也的确有一些研究支持这个假说。Elsby和他的合作者们发现了一些证据证明在那些受进口冲击更强的行业内,劳动收入占比的确下降得更厉害。已经有大量的文献研究国际贸易对于工资收入不平等的影响,而直到最近,人们才开始考虑它对于劳动收入占比的影响[xxi]。

CONCLUSIONS

结论

Despite several measurement issues and alternative definitions associated with the labor share, the message is quite clear: The 2000s witnessed an unprecedented drop in the labor share of income. Exploring the early period, we saw that the U.S. economy had been able to accommodate the surplus workers from manufacturing only until the late 1980s.

除了一些测量方法上的问题,以及与劳动收入占比相关的一些不同定义之外,我们所获得的信号是非常清晰的:21世纪的前十年见证了美国劳动收入占比的一场史无前例的急剧下降。通过对更早的时期进行研究,我们发现直到1980年代末期,美国一直都能够容纳制造业中多余的劳动力。

We also saw that the stagnation of wages, rather than accelerated labor productivity, has been behind the drop in the labor share from 2000 onward. The review of possible hypotheses behind the decline in the U.S. labor share was, admittedly, quite inconclusive: Economists do not yet have a full grasp of the underlying determinants.

我们还发现,工资增长的停滞,而不是劳动力产出的提升,才是2000年之后劳动收入占比下降的主要原因。需要承认的是,对于一些可能解释美国劳动收入占比下降的假说的回顾并没有得出什么明确的结论:经济学家们仍然没能完整地把握这一现象背后的那些潜在因素。

Once again we see two clearly separate periods. Until the early 1980s, labor productivity and wages grew at a very similar rate — if anything, the wage rate out-paced productivity, which, as described earlier, implies that the labor share in manufacturing inched up. By mid-1985, labor productivity took off, while wage growth was very sluggish. Since then, the gap between productivity and wages has kept growing, depressing the labor share.

我们又一次地看到了两个被明显分隔开的时期。直到上世纪80年代早期,劳动生产率和工资都一直在以很接近的速度增长——如果有不同的话,也是工资的增长速度超过了劳动生产率。按照之前的描述,这意味着制造业中的劳动收入占比提高了。到上世纪80年代中期,劳动生产率开始突飞猛进,而工资的增长则变得非常缓慢。从那以后,劳动生产率和工资之间的差距就开始持续扩大,从而不断压低劳动收入占比。

Because an index is used to scale both series, it is a tad difficult to grasp from the figure whether labor productivity accelerated or wage rates stagnated from the 1980s onward. The answer is both things happened. In the 1980s, productivity grew at about its long-term trend rate, but wages were virtually flat, growing less than half a percentage point a year on average over the decade. Wage growth recovered in the 1990s, but productivity actually took off, further increasing the gap. Overall, though, it appears that the fall in the labor share is explained mainly by the sluggish growth of wages rather than above-trend labor productivity.

由于我们使用同一个坐标来衡量两条曲线的变化,想要从图中分辨出1980年后究竟是劳动生产率的增长加速了还是单位时间工资的增长停滞了似乎有些困难。答案是两件事情都发生了。在1980年代,劳动生产率的增长速度基本上等于它的长期平均增长率,但是工资增长则相当平缓,这十年中的年均增长率不到0.5%。工资的增长在1990年代有所恢复,但是生产率的增长则突飞猛进,让两者间的差距越来越大。但是整体看来,劳动收入占比的下降更为主要的原因还是缓慢的工资增长速度,而不是增长的劳动生产率。

CONCURRENT PHENOMENA

一些并发的现象

What is the ultimate cause behind the decline of the labor share in the U.S.? The honest answer is that economists have several hypotheses but no definite answer yet. Rather than go over the sometimes-intricate theories behind these hypotheses, I will discuss the main observation or phenomenon anchoring each one.

美国劳动收入占比下降背后的终极原因到底是什么?诚实的回答是,经济学家们目前只是提出了一些假说,但还没有得到确定的答案[xv]。在本文中,我并不准备把这些假说背后的那些有时看起来错综复杂的理论复述一遍,而将讨论与每个假说相关的主要观察结果或现象。

Capital deepening

资本深化

This is by far the most popular hypothesis: Workers have been replaced by equipment and software. Who has not seen footage of robots working an auto assembly line? Older readers may remember when live tellers and not ATMs dispensed cash at banks. Software is now capable of piloting planes and, even more amazingly, doing our taxes!

这是至今为止最流行的假说:工人正在不断地被设备和软件所替代。今天谁还没有见过机器人在汽车流水线上的身影呢?年纪大一些的读者们可能还记得,在过去银行是使用出纳员而不是ATM机来分发现金的。当时的软件还不具备为飞机导航的能力,而更令今人惊讶的是,它们甚至还无法计算我们的税单!

There is more behind this hypothesis than anecdotes. Loukas Karabarbounis and Brent Neiman document a fall in equipment prices. Lawrence Summers proposes that capital should be viewed as at least a partial substitute for labor — more and more so as technology develops. In both models, the idea is similar: Better or cheaper equipment replaces workers and redistributes income from labor to capital. The result is that production becomes more intensive in capital, which is why these theories are often referred to as capital deepening.

这个假说背后有着远比这些旧日轶闻深刻得多的内容。Loukas Karabarbounis和Brent Neiman证明了设备价格的下降趋势。Lawrance Summers则提出,资本至少应该被看作劳动力的一种部分替代——而随着技术的发展,替代的程度也越来越高。在这两个模型中,观点是相似的:更好或者更便宜的设备替代了工人的劳动,并且将之前属于劳动的一部分收入重新分配给了资本。结果就是生产过程的资本密集程度越来越高,这也是这些理论通常被人们称为“资本深化”的原因。

It is important to understand that the capital deepening mechanism must operate at the level of the overall economy. So, when we see a robot replace, say, five workers, we need to remember that the production of the robot itself involved workers, so we are swapping auto assemblers with robot assemblers. It is, of course, still possible that the robot tilts income toward capital, but it is not a foregone conclusion.

重要的是,我们必须懂得资本深化机制只有在整体经济的尺度上才能发挥作用。所以当我们看到一个机器人替代了5名工人时,我们应该记住,机器人的生产本身也需要工人,所以我们只是把汽车装配工换成了机器人装配工而已。当然,机器人的确很有可能会让收入的天平向资本倾斜,但这并非已成定局。

The main challenge to capital deepening is that if a sector is substituting robots for workers to save money or improve the quality of the good being produced, the remaining workers should therefore become more productive and, overall, the sector should be expanding. In other words, capital deepening can reduce the labor share of income, but it does so by making labor productivity accelerate rather than making wages stagnate. As we saw earlier, this does not fit the actual picture of the manufacturing sector at all.

对资本深化理论的主要挑战是,如果某个部门通过使用机器人代替工人来节省成本或者提高所生产的产品质量,那么剩下的工人的生产效率就应该变得更高,而在整体上,这个部门应该会在扩张之中。换句话说,资本深化会降低劳动在总收入中所占的比例,但这是通过让劳动生产率获得提升来完成的,而不是让工资的增长停滞。就像我们之前所看到的,这与制造业所呈现的实际图景完全不相符[xvi]。

Income inequality

收入不平等

The increase in income inequality in the U.S. has lately received a lot of attention. The decline of the labor share is a force toward income inequality because capital is more concentrated across households than labor is.

最近,美国收入不平等的加剧获得了大量的关注。劳动收入占比下降显然是一种加剧收入不平等的力量,因为相比劳动力,资本在家庭间的分布集中度显然更高[xvii]。

It should be noted, though, that the main driver of the increase in income inequality is not capital income but rather wages themselves, particularly at the very top of the pay ladder. As Elsby and his coauthors document, the increase in top wages has actually sustained the labor share. In other words, the decline in the labor share actually understates the increase in income inequality.

但值得一提的是,收入不平等加剧的主要驱动力并不是资本收入,而是工资收入本身,尤其是在工资收入阶梯的顶端[xviii]。正如Elsby和他的合作者们所证明的,顶端工资的增长实际上会起到维持劳动收入占比的作用。换句话说,劳动收入占比的下降实际上还低估了收入不平等程度的加剧。

An interesting question is whether whatever is driving up inequality is also driving down the labor share. Several economists have proposed that technological change is skill biased — that is, it augments productivity more for highly skilled workers than for low-skilled workers. Combined with the idea that capital helps highly skilled workers be more productive but makes unskilled workers redundant, skill bias can explain both the increase in wage inequality and the decline in the labor share.

一个有趣的问题是,任何加剧收入不平等程度的因素是否也同样会降低劳动收入占比呢?一些经济学家提出,技术进步对于工人技能的影响是有偏的——也就是说,相对于低技能的工人,技术进步会更大地提升那些高技能工人的生产力。与之前得出的资本在帮助高技能工人提高生产力同时,让低技能工人变得冗余的观点相结合,“技能偏好”能够同时解释工资收入不平等程度的加剧和劳动收入占比的降低[xix]。

Let us return once more to the car manufacturer example. The robot may be replacing five unskilled workers but may require a qualified operator. The demand for unskilled workers falls, and so do their wages; but the demand for qualified operators increases, and so do their wages. So it is possible to have an increase in wage inequality while factories undergo capital deepening.

让我们再次回到汽车制造商的例子。机器人可能会替代掉5名不熟练的工人,但同时却会需要一名合格的操作员。对不熟练工人的需求下降了,他们的工资收入也会同时下降;但是对合格的操作员的需求和他们的工资水平则会同步提升。所以随着工厂经历资本深化的过程,工资收入的不平等程度也很可能会加剧。

Globalization.

全球化

Another popular hypothesis links the fall in the labor share with the advent of international trade liberalization. There is no question that there has been a substantial increase in trade by U.S. firms in the past few decades. In particular, firms have shifted parts of their production processes to foreign countries to take advantage of cheaper inputs — which, from the perspective of a country like the U.S. that has more capital than other countries, means cheap labor. Industries that are more intensive in labor, such as manufacturing, will be more likely to outsource their production processes abroad, and thus the remaining factories are likely to be the ones that rely more on capital.

另一个流行的假说将劳动收入占比的下降与国际贸易自由化的出现联系在了一起。毫无疑问,在过去的几十年中,美国公司所进行的国际贸易经历了非常显著的增长。尤其值得一提的是,许多美国公司都将它们的一部分生产流程转移到了国外以利用更加便宜的生产要素——对于美国这样一个比他国拥有更多资本的国家来说,也就是劳动力。劳动力更加密集的那些行业,例如制造业,将更有可能将生产流程外包到国外,而那些留在国内的工厂则更可能属于那些对资本依赖程度较高的行业。

Surprisingly, there is not a lot of evidence to support this view. The main challenge to the hypothesis is that U.S. exports and imports are very similar in their factor composition. That is, were trade driving down the labor share, we would observe the U.S. importing goods that use a lot of labor and exporting goods that use a lot of capital. Instead, most international trade involves exchanging goods that are very similar, such as cars.

令人吃惊的是,并没有多少证据能够支持这个观点。这一假说所面临的主要挑战是,美国的进口和出口在要素构成上其实非常相似。也就是说,如果说国际贸易降低了美国的劳动收入占比,那么我们会观察到美国所进口的产品的生产要素中包含大量的劳动,而出口产品的生产要素中则包含大量的资本。但实际上,大多数的国际贸易中所交换的产品都非常相似,例如汽车[xx]。

Another prediction of the globalization theory is that countries the U.S. exports to should see their labor shares increase and — as noted in the accompanying discussion, it appears that the decline in the labor share is a global phenomenon.

支持全球化降低了美国劳动收入占比的理论所作出的另一项预测是,那些从美国进口多于向美国出口的国家的劳动收入占比应该会上升——而我们在之前的讨论中已经提到过,劳动收入占比下降似乎是一个全球性的现象。

Some studies, though, do support this hypothesis. Elsby and his coauthors find some evidence that the labor share fell more in sectors that were more exposed to imports. There is a large body of literature on the impact of trade on wage inequality that only recently has started to consider the impact on the labor share.

事实上,也的确有一些研究支持这个假说。Elsby和他的合作者们发现了一些证据证明在那些受进口冲击更强的行业内,劳动收入占比的确下降得更厉害。已经有大量的文献研究国际贸易对于工资收入不平等的影响,而直到最近,人们才开始考虑它对于劳动收入占比的影响[xxi]。

CONCLUSIONS

结论

Despite several measurement issues and alternative definitions associated with the labor share, the message is quite clear: The 2000s witnessed an unprecedented drop in the labor share of income. Exploring the early period, we saw that the U.S. economy had been able to accommodate the surplus workers from manufacturing only until the late 1980s.

除了一些测量方法上的问题,以及与劳动收入占比相关的一些不同定义之外,我们所获得的信号是非常清晰的:21世纪的前十年见证了美国劳动收入占比的一场史无前例的急剧下降。通过对更早的时期进行研究,我们发现直到1980年代末期,美国一直都能够容纳制造业中多余的劳动力。

We also saw that the stagnation of wages, rather than accelerated labor productivity, has been behind the drop in the labor share from 2000 onward. The review of possible hypotheses behind the decline in the U.S. labor share was, admittedly, quite inconclusive: Economists do not yet have a full grasp of the underlying determinants.

我们还发现,工资增长的停滞,而不是劳动力产出的提升,才是2000年之后劳动收入占比下降的主要原因。需要承认的是,对于一些可能解释美国劳动收入占比下降的假说的回顾并没有得出什么明确的结论:经济学家们仍然没能完整地把握这一现象背后的那些潜在因素。

——海德沙龙·翻译组,致力于将英文世界的好文章搬进中文世界——